https://georgetown.app.box.com/v/2026MarketplaceRatesMemo

CHIR Submits Analysis to U.S. Senators on Double Digit Rate Increases Proposed for the Marketplace in 2026

https://www.commonwealthfund.org/blog/2025/congress-and-administration-are-using-paperwork-discourage-enrollment-marketplace

Congress and the Administration Are Using Paperwork to Discourage Enrollment in Marketplace Insurance

Jalisa Clark, Justin Giovannelli, Christine Monahan

https://www.commonwealthfund.org/blog/2025/trump-administration-and-congress-reduce-federal-health-spending-expense-states-consumers

Trump Administration and Congress Reduce Federal Health Spending at the Expense of States, Consumers, and Millions of Newly Uninsured

Rachel Swindle and Justin Giovannelli

https://georgetown.box.com/s/xf7gogtb5gwergrtx6gv22ez9itlwjkp

Supporting Consumers and Confronting Problematic Billing Practices

Sabrina Corlette, Kennah Watts

https://georgetown.app.box.com/s/cb979rouevzzav37fas71k2bdxet6qut

Dental Coverage Through the Marketplace: A 2024 Snapshot of Enrollment, Market Participation and Premiums

Zeynep Celik, Kevin Lucia, JoAnn Volk, Liz Bielic, Madeline McBride

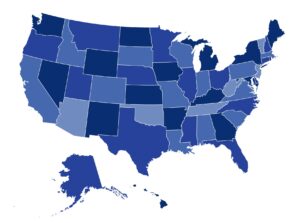

https://chir.georgetown.edu/diabetes/state-reforms/

Insulin-Requiring Diabetes Coverage, Affordability, and Access in State-Regulated Private Health Insurance

Amy Killelea, Christine H. Monahan, Billy Dering, Hanan Rakine, Vrudhi Raimugia

https://www.commonwealthfund.org/blog/2025/new-rule-limit-aca-enrollment-periods-may-deter-sign-ups-and-worsen-risk-pools

A New Rule to Limit ACA Enrollment Periods May Deter Sign-Ups and Worsen Risk Pools

Sabrina Corlette, Rachel Swindle

https://www.commonwealthfund.org/blog/2025/new-administration-plans-reinstate-cuts-funding-aca-outreach-and-enrollment-assistance

New Administration Plans to Reinstate Cuts to Funding for ACA Outreach and Enrollment Assistance

Rachel Swindle, Jalisa Clark, Justin Giovannelli

https://www.commonwealthfund.org/blog/2025/new-federal-rule-can-help-ensure-patients-get-behavioral-health-care-they-need

A New Federal Rule Can Help Ensure Patients Get the Behavioral Health Care They Need

JoAnn Volk and Billy Dering

https://georgetown.app.box.com/s/ore81xn7vgvmtz0bb0ycljqx0bh2ow2n

Building Behavioral Health System Capacity

This report, supported by the National Institute for Health Care Reform, examines strategies to build and sustain the capacity of the BH delivery system.

Maanasa Kona, Stacey Pogue, Kennah Watts

https://www.commonwealthfund.org/blog/2025/policymakers-can-protect-against-fraud-aca-marketplaces-without-hiking-premiums

Policymakers Can Protect Against Fraud in the ACA Marketplaces Without Hiking Premiums

Justin Giovannelli and Stacey Pogue

https://www.commonwealthfund.org/blog/2024/report-shows-dispute-resolution-process-no-surprises-act-favors-providers

Report Shows Dispute Resolution Process in No Surprises Act Favors Providers

Jack Hoadley, Kevin Lucia

https://georgetown.box.com/s/a9h0u93epp2on7gxwnj57g4cftj9azsc

Bringing Balance to the Market: A Roadmap for Improving Health Insurance Affordability Through Rate Review

Sabrina Corlette, Karen Davenport

https://georgetown.box.com/s/10rb0biyiunjnwv5k9rwi7rjuewxg547

Protecting Consumers From the Corporate Transformation of Health Care

As corporations and private equity increasingly take control of our health care systems and profits take precedence over care, patients are caught in the middle.

Sabrina Corlette, Kennah Watts

https://georgetown.app.box.com/file/1793698465588?s=sel2hjut1pp5x4qnm5ngzmkoaf4wc51a

How Has Corporatization Transformed Your State’s Healthcare Market?

A guide for policymakers and state regulators to understand the extent of corporatization in your state and how your state regulates corporate practices in healthcare.

Sabrina Corlette, Kennah Watts

https://www.commonwealthfund.org/blog/2024/states-forge-ahead-protect-consumers-advisory-committee-recommends-federal-action

States Forge Ahead to Protect Consumers, as Advisory Committee Recommends Federal Action on Surprise Ambulance Bills

Nadia Stovicek and Jack Hoadley

https://www.commonwealthfund.org/blog/2024/states-continue-enact-protections-patients-medical-debt

States Continue to Enact Protections for Patients with Medical Debt

https://www.chcf.org/wp-content/uploads/2024/08/EnrollmentCoveredCAFromMediCal.pdf

Clearing the Path: Streamlining Enrollment in Covered California for Californians Transitioning from Medi-Cal

JoAnn Volk, Sabrina Corlette, Justin Giovannelli, Kevin Lucia, Edwin Park

https://www.commonwealthfund.org/blog/2024/how-states-can-use-tax-and-unemployment-filings-sign-people-health-insurance

How States Can Use Tax and Unemployment Filings to Sign People Up for Health Insurance

Rachel Swindle, Rachel Schwab, Justin Giovannelli

https://www.commonwealthfund.org/blog/2024/raise-bar-state-based-marketplaces-using-quality-tools-enhance-health-equity

Raise the Bar: State-Based Marketplaces Using Quality Tools to Enhance Health Equity

Jalisa Clark and Christine Monahan

https://www.commonwealthfund.org/blog/2024/expanding-no-surprises-act-protect-consumers-surprise-ambulance-bills

Expanding the No Surprises Act to Protect Consumers from Surprise Ambulance Bills

Jack Hoadley, Nadia Stovicek

https://georgetown.app.box.com/file/1566669510563?s=antpaij8sk1n9989n97fkoq7ceambfjo

Understanding Federal and State Levers to Address Provider Consolidation

Maanasa Kona, Billy Dering, Emma Walsh-Alker

https://georgetown.box.com/s/ko751f98n3m42z2wmni3mk7280f5w6ta

The Good, The Bad, The Costly: State Efforts to Reform Prior Authorization Practices

Sabrina Corlette, Kennah Watts, Rachel Schwab

https://www.commonwealthfund.org/publications/issue-briefs/enforcing-mental-health-parity-state-options-improve-access-care

Enforcing Mental Health Parity: State Options to Improve Access to Care

JoAnn Volk, Emma Walsh-Alker, Christina L. Goe

https://www.commonwealthfund.org/blog/2024/states-expand-access-affordable-private-coverage-immigrant-populations

States Expand Access to Affordable Private Coverage for Immigrant Populations

Justin Giovannelli and Rachel Schwab

https://www.commonwealthfund.org/publications/issue-briefs/2024/sep/if-premium-tax-credits-expire-state-affordability-programs

If Expanded Federal Premium Tax Credits Expire, State Affordability Programs Won’t Be Enough to Stem Widespread Coverage Losses

Rachel Swindle, Justin Giovannelli

https://georgetown.box.com/s/e8p5ydl0s8fxjtovcdnw1dwqecx8v2nf

Understanding and Mitigating Behavioral Health Workforce Shortages

Maanasa Kona, Stacey Pogue, Kennah Watts

https://www.commonwealthfund.org/publications/issue-briefs/2024/nov/enhancing-essential-health-benefits-states-updating-benchmark-plans

Enhancing Essential Health Benefits: How States Are Updating Benchmark Plans to Improve Coverage

Stacey Pogue, Vrudhi Raimugia, Justin Giovannelli, Kevin Lucia

https://medicarecompendium.chir.georgetown.edu/

Compendium of Policy Proposals for Medicare Advantage and Part D

https://www.commonwealthfund.org/blog/2024/ensuring-access-behavioral-health-providers

Ensuring Access to Behavioral Health Providers

JoAnn Volk, Christina L. Goe, Justin Giovannelli

https://www.commonwealthfund.org/blog/2024/state-options-making-hospital-financial-assistance-programs-more-accessible

State Options for Making Hospital Financial Assistance Programs More Accessible

https://www.commonwealthfund.org/blog/2023/what-states-are-doing-keep-people-covered-medicaid-continuous-enrollment-unwinds

What States Are Doing to Keep People Covered as Medicaid Continuous Enrollment Unwinds

https://www.commonwealthfund.org/blog/2023/health-care-sharing-ministries-leave-consumers-unpaid-medical-claims

Health Care Sharing Ministries Leave Consumers with Unpaid Medical Claims

JoAnn Volk, Justin Giovannelli, Christina L. Goe

https://www.commonwealthfund.org/blog/2023/state-public-option-plans-are-making-progress-reducing-consumer-costs

State Public Option Plans Are Making Progress on Reducing Consumer Costs

Christine Monahan, Nadia Stovicek, Justin Giovannelli

https://www.commonwealthfund.org/blog/2023/state-health-equity-initiatives-confront-decades-racism-insurance-industry

State Health Equity Initiatives Confront Decades of Racism in the Insurance Industry

Jalisa Clark and Christine Monahan

https://www.commonwealthfund.org/blog/2023/biden-administration-sets-limits-use-short-term-health-insurance-plans-states-can-do-more

Biden Administration Sets Limits on Use of Short-Term Health Insurance Plans, But States Can Do More to Protect Consumers

Justin Giovannelli, Kevin Lucia, Christina L. Goe

https://www.commonwealthfund.org/blog/2023/building-behavioral-health-parity-state-options-strengthen-access-care

Building on Behavioral Health Parity: State Options to Strengthen Access to Care

JoAnn Volk and Christina L. Goe

https://www.commonwealthfund.org/blog/2023/coverage-preventive-services-without-cost-sharing-jeopardy-texas-court-strikes-down-aca

Coverage of Preventive Services Without Cost Sharing in Jeopardy as Texas Court Strikes Down ACA Protection

Justin Giovannelli and Rachel Schwab

https://www.commonwealthfund.org/blog/2023/states-act-strengthen-surprise-billing-protections-even-after-passage-no-surprises-act

States Act to Strengthen Surprise Billing Protections Even After Passage of No Surprises Act

Madeline O’Brien, Jack Hoadley

https://www.milbank.org/publications/assessing-the-effectiveness-of-policies-to-improve-access-to-primary-care-for-underserved-populations-a-case-study-analysis-of-columbia-county-arkansas/

Assessing the Effectiveness of Policies to Improve Access to Primary Care for Underserved Populations: A Case Study Analysis of Columbia County, Arkansas

Maanasa Kona, Jalisa Clark, Megan Houston, Emma Walsh-Alker

https://www.rwjf.org/en/insights/our-research/2023/04/no-surprises-act--perspectives-on-status-of-consumer-protections-against-balance-billing.html

No Surprises Act: Perspectives on the Status of Consumer Protections Against Balance Billing

Jack Hoadley, Kevin Lucia, JoAnn Volk, Emma Walsh-Alker, Rachel Swindle, Erik Wengle

https://www.milbank.org/publications/assessing-the-effectiveness-of-policies-to-improve-access-to-primary-care-for-underserved-populations-case-study-analysis-detroit-michigan/

Assessing the Effectiveness of Policies to Improve Access to Primary Care for Underserved Populations, Case Study Analysis: Detroit, Michigan

Maanasa Kona, Megan Houston, Emma Walsh-Alker, Yareli Torres Carrillo

https://www.rwjf.org/en/insights/our-research/2023/04/the-basic-health-program.html

The Basic Health Program: Considerations for States and Lessons from New York and Minnesota

Sabrina Corlette, Jason Levitis, Erik Wengle, Rachel Swindle

https://www.milbank.org/publications/assessing-the-effectiveness-of-policies-to-improve-access-to-primary-care-for-underserved-populations-case-study-analysis-kanawha-county-west-virginia/

Assessing the Effectiveness of Policies to Improve Access to Primary Care for Underserved Populations, Case Study Analysis: Kanawha County, West Virginia

Maanasa Kona, Jalisa Clark, Emma Walsh-Alker, Megan Houston

https://sehpcostcontainment.chir.georgetown.edu/documents/Mixed-Results-Cost-Growth.pdf

Mixed Results: State Employee Health Plans Face Challenges, Find Opportunities to Contain Cost Growth

Sabrina Corlette, Karen Davenport, Emma Walsh-Alker

https://georgetown.box.com/v/statefacilityfeeissuebrief

Regulating Outpatient Facility Fees: States Are Leading the Way to Protect Consumer

Christine H. Monahan, Karen Davenport, Rachel Swindle, Caroline Picher

https://georgetown.box.com/v/statefacilityfeereport

Protecting Patients from Unexpected Outpatient Facility Fees: States on the Precipice of Broader Reform

Christine H. Monahan, Karen Davenport, Rachel Swindle

https://georgetown.box.com/v/the-perfect-storm-august-2023

The Perfect Storm: Misleading Marketing of Limited Benefit Products Continues as Millions Losing Medicaid Search for New Coverage

Rachel Schwab, JoAnn Volk

https://www.commonwealthfund.org/blog/2023/state-protections-maintaining-access-after-transitioning-medicaid

The State of State Protections: Maintaining Access to Services After Transitioning from Medicaid

Sabrina Corlette, Maanasa Kona

https://www.commonwealthfund.org/publications/fund-reports/2023/sep/state-protections-medical-debt-policies-across-us

State Protections Against Medical Debt: A Look at Policies Across the U.S.

Maanasa Kona, Vrudhi Raimugia

https://www.commonwealthfund.org/publications/issue-briefs/2023/sep/uneven-ground-differences-language-access-state-based-marketplaces

Uneven Ground: Differences in Language Access Across State-Based Marketplaces

Christine Monahan, Jalisa Clark, Nadia Stovicek

https://georgetown.box.com/v/looking-under-the-hood

Looking Under the Hood: Enhanced Health Insurance Rate Review to Improve Affordability

Sabrina Corlette, Vrudhi Raimugia

https://www.milbank.org/publications/improving-access-to-primary-care-for-underserved-populations-a-review-of-findings-from-five-case-studies-and-recommendations/

Improving Access to Primary Care for Underserved Populations: A Review of Findings from Five Case Studies and Recommendations

Maanasa Kona, Jalisa Clark, Emma Walsh-Alker

https://www.commonwealthfund.org/publications/issue-briefs/2023/nov/policy-innovations-affordable-care-act-marketplaces

Policy Innovations in the Affordable Care Act Marketplaces

Rachel Schwab, Rachel Swindle, Jalisa Clark, Justin Giovannelli

https://www.commonwealthfund.org/blog/2023/states-move-forward-public-option-programs-insurance-carriers

States Move Forward with Public Option Programs, but Differ in How They Select Insurance Carriers

Christine Monahan and Madeline O’Brien

https://www.commonwealthfund.org/blog/2022/state-telemedicine-coverage-requirements-continue-evolve

State Telemedicine Coverage Requirements Continue to Evolve

JoAnn Volk, Madeline O’Brien, Christina L. Goe

https://www.commonwealthfund.org/blog/2022/implementing-family-glitch-fix-affordable-care-acts-marketplaces

Implementing the Family Glitch Fix on the Affordable Care Act’s Marketplaces

Rachel Schwab, Rachel Swindle, Justin Giovannelli

https://www.commonwealthfund.org/blog/2022/aca-preventive-services-benefit-jeopardy-what-can-states-do

The ACA’s Preventive Services Benefit Is in Jeopardy: What Can States Do to Preserve Access?

Justin Giovannelli, Sabrina Corlette, Madeline O’Brien

https://www.commonwealthfund.org/blog/2022/congressional-proposals-federal-public-health-insurance-option

Congressional Proposals for a Federal Public Health Insurance Option

Christine Monahan, Kevin Lucia

https://www.commonwealthfund.org/publications/fund-reports/2022/oct/no-surprises-act-federal-state-partnership-protect-consumers

No Surprises Act: A Federal–State Partnership to Protect Consumers from Surprise Medical Bills

Jack Hoadley, Madeline O’Brien, Kevin Lucia

https://www.commonwealthfund.org/blog/2022/using-health-insurance-reform-reduce-disparities-diabetes-care

Using Health Insurance Reform to Reduce Disparities in Diabetes Care

Christine Monahan and Jalisa Clark

https://www.commonwealthfund.org/blog/2022/hhs-approves-nations-first-section-1332-waiver-public-option-plan-colorado

HHS Approves Nation’s First Section 1332 Waiver for a Public Option–Style Health Care Plan in Colorado

Christine Monahan, Justin Giovannelli, Kevin Lucia

https://www.commonwealthfund.org/blog/2022/improving-race-and-ethnicity-data-collection-first-step-furthering-health-equity-through

Improving Race and Ethnicity Data Collection: A First Step to Furthering Health Equity Through the State-Based Marketplaces

Dania Palanker, Jalisa Clark, Christine Monahan

https://www.commonwealthfund.org/blog/2022/mitigating-coverage-loss-when-public-health-emergency-ends

Mitigating Coverage Loss When the Public Health Emergency Ends

Sabrina Corlette, Maanasa Kona

https://www.commonwealthfund.org/blog/2022/californias-marketplace-tries-new-tactics-reduce-number-uninsured-and-underinsured

California’s Marketplace Tries New Tactics to Reduce the Number of Uninsured and Underinsured

Rachel Schwab, Justin Giovannelli, Kevin Lucia

https://www.commonwealthfund.org/blog/2022/update-state-public-option-style-laws-getting-more-affordable-coverage

Update on State Public Option-Style Laws: Getting to More Affordable Coverage

Christine Monahan, Justin Giovannelli, Kevin Lucia

https://www.commonwealthfund.org/blog/2022/massachusetts-data-health-care-sharing-ministries-reveal-finances-put-consumers-risk

Massachusetts Data on Health Care Sharing Ministries Reveal Finances That Put Consumers at Risk

JoAnn Volk, Justin Giovannelli, Christina L. Goe

https://www.commonwealthfund.org/blog/2022/ensuring-adequacy-aca-marketplace-plan-networks

Ensuring the Adequacy of ACA Marketplace Plan Networks

https://www.milbank.org/publications/the-effectiveness-of-policies-to-improve-primary-care-access-for-underserved-populations/

The Effectiveness of Policies to Improve Primary Care Access for Underserved Populations: An Assessment of the Literature

Maanasa Kona, Megan Houston, Nia Gooding

https://www.rwjf.org/en/library/research/2022/03/preparing-for-the-biggest-coverage-event-since-the-affordable-care-act.html

Preparing for the Biggest Coverage Event Since the Affordable Care Act

Sabrina Corlette, Linda Blumberg, Megan Houston, Erik Wengle

https://www.rwjf.org/en/library/research/2022/03/assessing-federal-and-state-network-adequacy-standards-for-medicaid-and-the-marketplace.html

Access to Services in Medicaid and the Marketplaces

Sabrina Corlette, Andy Schneider, Maanasa Kona, Alexandra Corcoran, Rachel Schwab, Megan Houston

https://www.shvs.org/resource/the-end-of-the-public-health-emergency-will-prompt-massive-transitions-in-health-insurance-coverage-how-state-insurance-regulators-can-prepare/

The End of the Public Health Emergency Will Prompt Massive Transitions in Health Insurance Coverage: How State Insurance Regulators Can Prepare

https://www.commonwealthfund.org/publications/issue-briefs/2022/apr/what-four-states-are-doing-advance-health-equity-marketplace

What Four States Are Doing to Advance Health Equity in Marketplace Insurance Plans

Dania Palanker, Nia Denise Gooding

https://www.milbank.org/publications/assessing-the-effectiveness-of-policies-to-improve-access-to-primary-care-for-underserved-populations-case-study-analysis-of-grant-county-new-mexico/?utm_medium=email&utm_campaign=Report%20Grant%20County%20NM%20PC%20Policies%20--%2020220513&utm_content=Report%20Grant%20County%20NM%20PC%20Policies%20--%2020220513+CID_d419f390e73f22f669fe39e33e5a3789&utm_source=Email%20Campaign%20Monitor&utm_term=Read%20more

Assessing the Effectiveness of Policies to Improve Access to Primary Care for Underserved Populations: A Case Study Analysis of Grant County, New Mexico

Maanasa Kona, Jalisa Clark, Megan Houston, Emma Walsh-Alker

https://georgetown.box.com/s/qljs9kpo467k3ahpaap7gqya5byzulgr

Assessing and Supporting State Employee Health Plans’ Cost Containment Initiatives: Final Report

Sabrina Corlette, Maanasa Kona

https://www.milbank.org/publications/assessing-the-effectiveness-of-policies-to-improve-access-to-primary-care-for-underserved-populations-a-case-study-analysis-of-baltimore-city-maryland/

Assessing the Effectiveness of Policies to Improve Access to Primary Care for Underserved Populations: A Case Study Analysis of Baltimore City, Maryland

Maanasa Kona, Jalisa Clark, Megan Houston, Emma Walsh-Alker

https://www.rwjf.org/en/library/research/2022/10/states-struggle-to-ensure-equal-access-to-behavioral-health-services-amid-mental-health-crisis.html

States Struggle to Ensure Equal Access to Behavioral Health Services Amid Mental Health Crisis

JoAnn Volk, Rachel Schwab, Maanasa Kona, Emma Walsh-Alker

https://www.commonwealthfund.org/publications/issue-briefs/2022/oct/state-based-outreach-boosting-enrollment-uninsured

State-Based Marketplace Outreach Strategies for Boosting Health Plan Enrollment of the Uninsured

Rachel Schwab, Rachel Swindle, Justin Giovannelli

https://www.nejm.org/doi/full/10.1056/NEJMp2206049

U.S. Health Insurance Coverage and Financing

Sabrina Corlette, Christine H. Monahan

https://www.commonwealthfund.org/blog/2025/trump-administration-and-congress-reduce-federal-health-spending-expense-states-consumers

Trump Administration and Congress Reduce Federal Health Spending at the Expense of States, Consumers, and Millions of Newly Uninsured

Rachel Swindle, Justin Giovannelli