By Sabrina Corlette and Jason Levitis

On November 15, 2023, the U.S. Department of Health & Human Services (HHS) released a proposed rule to update standards that apply to Marketplaces and health plans under the Patient Protection & Affordable Care Act (ACA) for plan year 2025. In addition to the rule, referred to as the Notice of Benefit & Payment Parameters or informally as the “Payment Rule” or “Payment Notice,” HHS released a fact sheet, a draft 2025 Letter to Issuers, a proposed 2025 Actuarial Value Calculator and methodology, and guidance providing updated numerical parameters for 2025. Comments on the proposed rule are due within 45 days of the rule’s publication in the Federal Register, and comments on the Draft Letter to Issuers are due on January 2, 2024.

The proposed 2025 NBPP builds on several policy priorities of President Biden’s administration. It includes proposals designed to expand Marketplace enrollment, improve the consumer experience, and raise standards for Marketplace plans nationwide. If finalized, these proposals will generally be effective on January 1, 2025, unless noted otherwise below.

In this Forefront article, we focus on market reforms, Marketplace standards, and Advance Premium Tax Credit policies. A second article by Matthew Fiedler discusses HHS’ proposals related to risk adjustment.

A Federal “Floor” For The Health Insurance Marketplaces

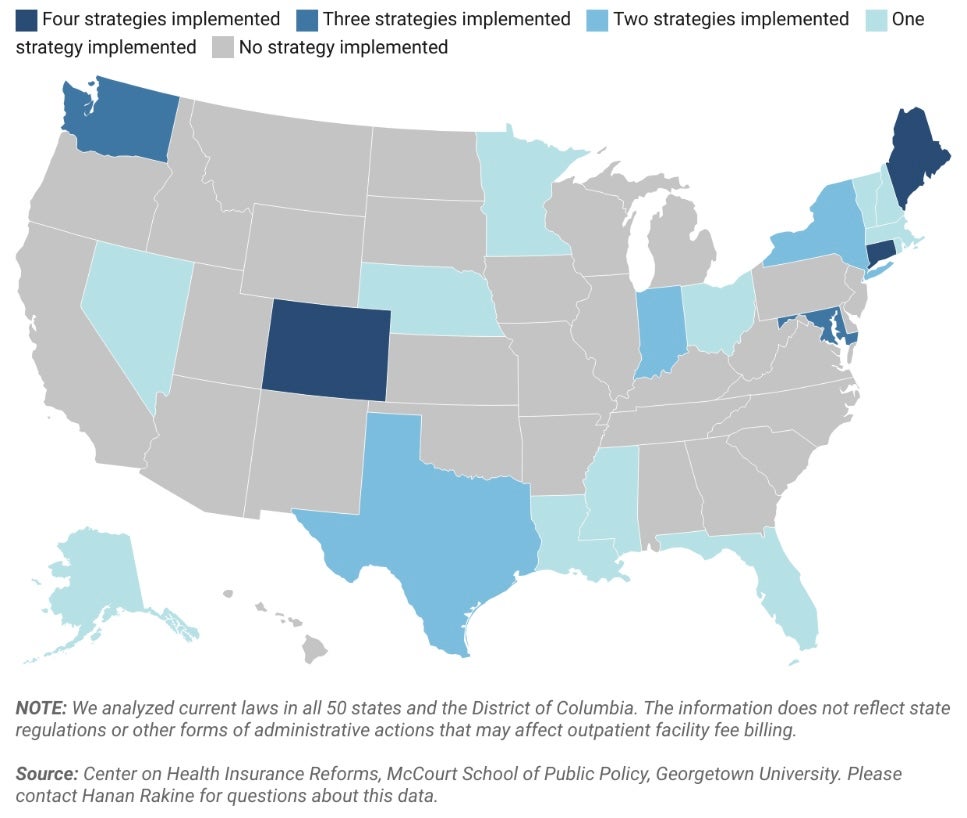

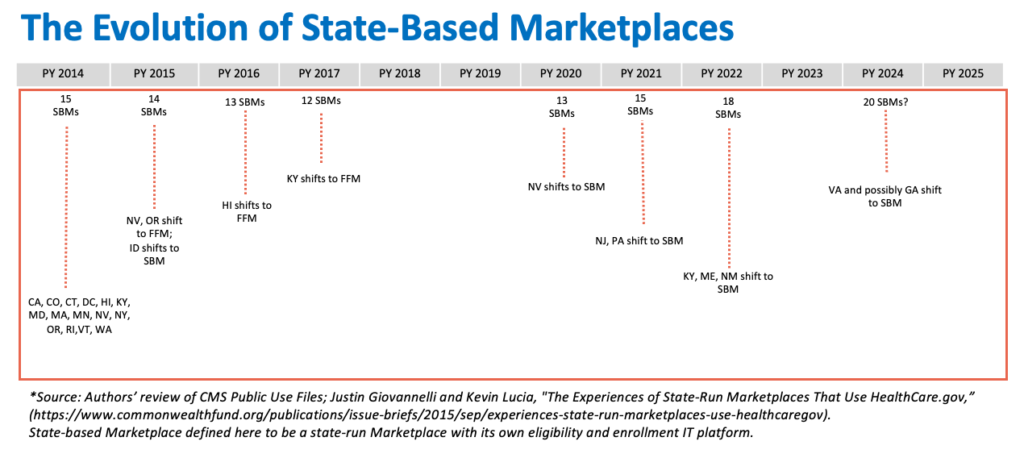

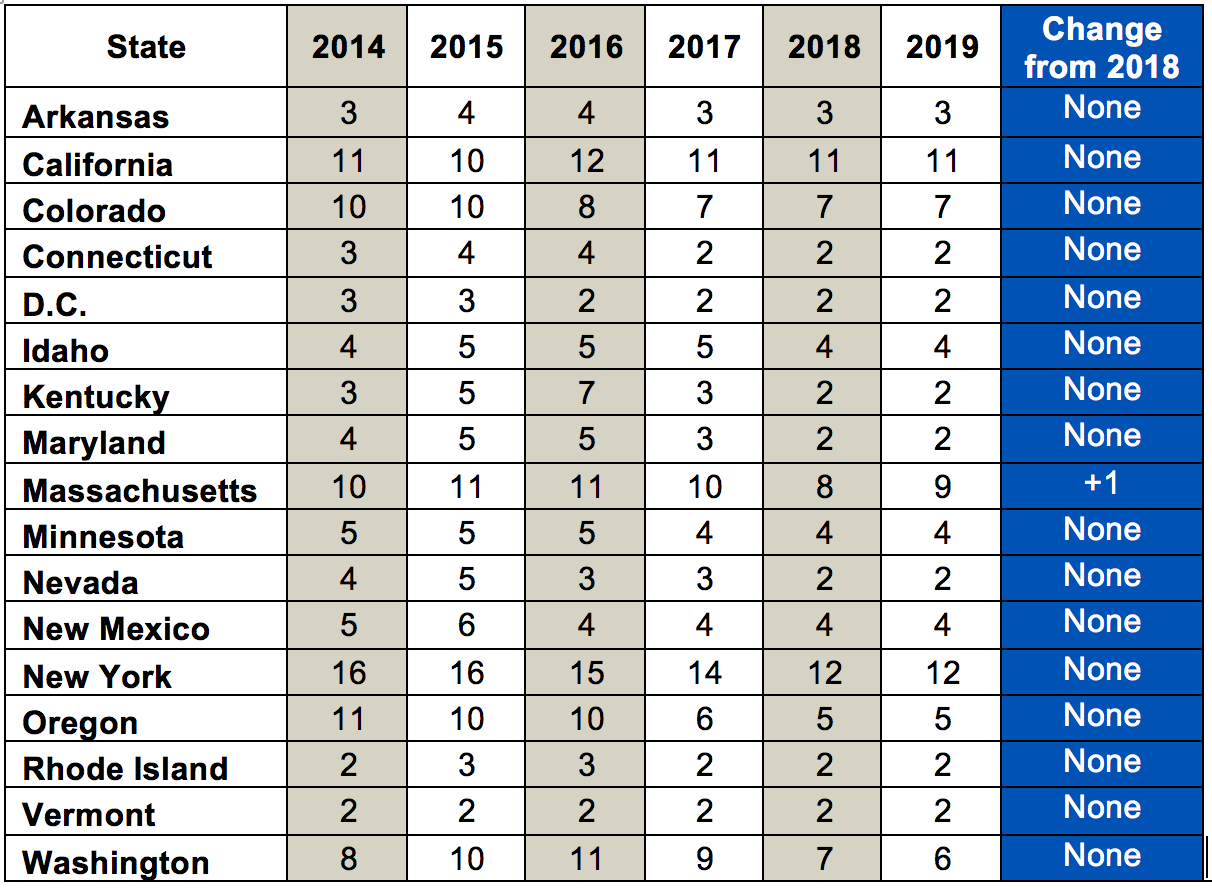

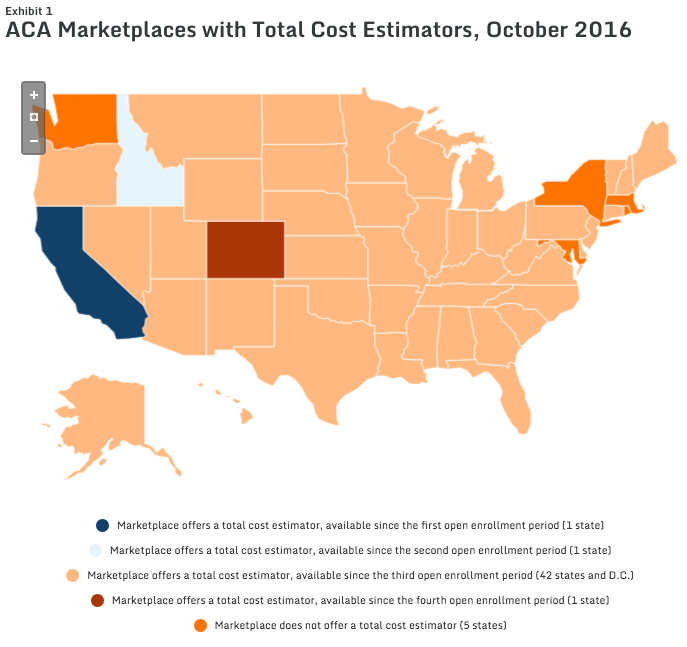

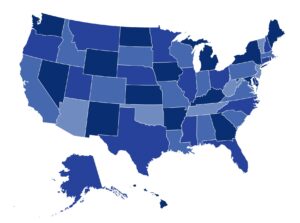

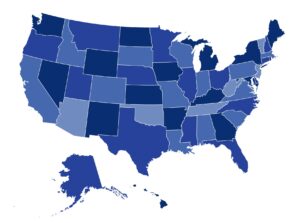

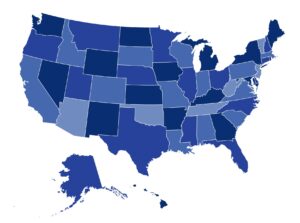

In the first decade of the ACA’s Marketplaces, the number of state-based Marketplaces (SBMs) has fluctuated from 15 in 2014 to a low of 12 in plan year 2017. Today, 18 states and D.C. operate an SBM, the federal government operates 29 Marketplaces, and three states run a Marketplace in partnership with HHS. Two more states, Georgia and Illinois, are expected to transition to an SBM for plan year 2025. Several other states are also considering transitions. In light of this, the administration makes several proposals that would set minimum national standards for the operation of the Marketplaces and the plans they offer.

A Graduated Transition

HHS proposes that a state seeking to operate an SBM must first operate as an SBM using the federal platform (SBM-FP) for at least one year, including during an open enrollment period. SBM-FPs conduct plan management, conduct outreach, and provide consumer assistance, but the eligibility and enrollment functions are performed by the federal government, through HealthCare.gov. HHS notes that building and maintaining an SBM requires “extensive start-up resources,” including investments in relationships with consumers, consumer assisters, eligibility and enrollment partners, insurers, and other parties.

Operating an SBM-FP for at least one year before taking on full operation of an SBM allows states time to implement critical eligibility and enrollment functions, contract with IT and other vendors, and coordinate with state partners such as Medicaid agencies and departments of insurance. The administration seeks comment on this proposal, including on whether a year is an appropriate duration of time for a state to operate as an SBM-FP before transitioning to an SBM.

A More Rigorous Approval Process

HHS proposes to require that states seeking to transition to an SBM submit supporting documentation to HHS through the Exchange Blueprint process. The Blueprint outlines the state’s plans for standing up and operating an SBM and must be approved by HHS. Under this proposal, states would be asked to submit detailed plans regarding consumer assistance programs and activities. It also would clarify that HHS has the authority to request any evidence necessary to assess the state’s ability to meet requirements for SBM functionality.

Additionally, HHS proposes that states be required to provide the public with notice and a copy of its Blueprint application at the time of submission; HHS would publicly post the state’s application within 90 days of receipt. At some point after submitting the Blueprint application, states would be required to conduct at least one “public engagement,” such as a townhall meeting. Further, until the state has received formal HHS approval for its SBM transition, it would be required to periodically conduct similar public engagements at which the public could learn about the state’s progress towards establishing an SBM.

Standards For Call Centers

All Marketplaces must, under current law, operate an accessible, toll-free call center that can respond to consumers’ requests for assistance. Once an SBM is established, HHS monitors call center operations through annual data reports that document call volume, wait times, abandonment rates, and average call handle time. While HHS declines at this time to set minimum staffing levels for Marketplace call centers, they are proposing that SBMs meet the following additional requirements:

- There must be guaranteed access to a live call center representative during published hours of operation; and

- Call center representatives must be able to assist consumers with Marketplace applications, including with information about eligibility for financial assistance, plan options, and enrollment applications.

HHS believes that all the current SBMs already meet these standards. However, the department wants to ensure that current and future SBMs provide a real-time opportunity for consumers to interact with a live representative and do not solely rely on an automated telephone system for consumer assistance.

A Centralized Eligibility And Enrollment Platform

Many consumers enroll in a Marketplace plan through broker or insurance company websites, using an HHS-approved process called Direct Enrollment (DE). The state of Georgia has previously proposed a disaggregated approach to Marketplace enrollment in which consumers sign up for plans and financial assistance directly through brokers or insurers, instead of through a centralized, government-run website. In this proposed rule, HHS would require that SBMs operate a centralized eligibility and enrollment platform on their own website so that consumers can submit a single, streamlined application for Marketplace enrollment and financial assistance. Further, the agency would clarify that it is the Marketplace, through its centralized platform, that is responsible for making all final determinations of a consumer’s eligibility for Marketplace coverage and financial assistance, even if the consumer initiates an application through a DE platform. HHS believes that the eligibility determination function is one that should only be performed by the government-operated Marketplaces. SBMs would be prohibited from solely relying on non-Marketplace entities, such as web-brokers, to make such determinations. This proposal would also ensure that SBMs can meet existing requirements that they maintain records of all effectuated enrollments.

HHS argues that consumers could be harmed if these proposals are not adopted, noting that if a non-Marketplace entity makes an incorrect eligibility determination, or has logic rules that are at odds with federal or state policies, it could impact the consumer’s eligibility for coverage and financial assistance, and also trigger potential tax liability when the consumer files their taxes and reconciles premium tax credits.

National Standards For Web-Brokers

HHS has established a set of standards for web-brokers that assist consumers with applications for the federally facilitated Marketplace (FFMs) and SBM-FPs. Under this proposal, those standards would be extended to web-brokers that assist with enrollments in the SBMs. Specifically, HHS’ standards for web-broker displays of plan information, disclaimer language, information about financial assistance, operational readiness, standards of conduct, and the behavior of downstream agents and brokers would apply across all Marketplaces, whether state- or federally run. The agency argues that establishing a nationwide set of standards is important given the “increased interest” among SBMs in using web-brokers to assist with enrollment.

The rule also addresses how these standards would apply to web-brokers in states with SBMs that exercise certain flexibilities with respect to plan display and the consumer experience. The proposal notes, for example, that web-brokers in SBM states should follow HealthCare.gov’s example for consumer-facing quality ratings, unless the SBM has modified the display of those ratings. Similarly, web-brokers in SBM states would need to follow disclaimer language provided by HHS “as a minimum starting point,” but SBMs could add state-specific language to the disclaimer so long as it doesn’t conflict with HHS’ language. States could also require web-brokers to translate disclaimer text into languages tailored to the states’ population.

HHS argues that a standardized framework and set of requirements across states would help reduce burdens on web-brokers that operate in multiple states. However, the agency also observes that state flexibility is important. Therefore, this proposal would establish a general requirement that SBMs set operational readiness standards for participating web-brokers, but SBMs would have the flexibility to determine the details of those standards.

HHS encourages public comments on these proposals, particularly from states operating, or seeking to operate, an SBM. These proposals, if finalized, would be made effective upon publication of the final rule.

National Standards For Direct Enrollment (DE) Entities

The FFM’s DE program enables consumers to enroll in Marketplace coverage and select a plan through partner entities, including web-brokers and insurers. The DE program has become a significant source of enrollment for the FFMs and SBM-FPs. In 2023, 81 percent of agent- or broker-assisted Marketplace plan selections were through the DE program, up from 72 percent in 2022.

Although no SBM currently operates a DE program, HHS believes current and future SBMs may seek to do so. In light of this, HHS is proposing to extend the FFM/SBM-FP standards for DE entities nationwide.

Existing federal standards for DE entities govern the marketing and display of Marketplace plans and non-Marketplace plans, help ensure that consumers receive correct information, require adherence to certain rules of conduct, regulate the marketing of non-Marketplace plans, establish website disclaimer language, and set expectations for operational readiness. In particular, federal safeguards aim to reduce consumer confusion between Marketplace and non-Marketplace plans, ensure appropriate eligibility determinations, and protect against privacy and security breaches. For example, DE entities participating in SBM states would be required to display Marketplace plans, off-Marketplace plans, and other products, such as excepted benefit products, on separate web pages on its non-Marketplace website. DE entities would also be required to limit marketing of non-Marketplace plans during open enrollment periods, in order to minimize consumer confusion.

HHS observes that, by setting minimum federal standards, it would relieve SBMs of some of the administrative burden of establishing a new DE program, which includes drafting new policies, updating standards, hiring new staff to select and monitor the DE entities, providing technical assistance, and creating and conducting operational readiness reviews, as well as ongoing oversight and enforcement in the case of non-compliance. HHS further notes that uniform requirements across all Marketplaces can alleviate burdens on DE entities from having to comply with different requirements across states. In general, under this proposal DE entities operating in SBM states would be required to comply with federal standards, but SBMs would be permitted some flexibility to adjust those standards to reflect local conditions, so long as they don’t conflict with the federal standards.

HHS encourages public comments on these proposals, particularly from states operating, or seeking to operate, an SBM. These proposals, if finalized, would be made effective upon publication of the final rule.

Standardizing Open Enrollment Periods

HHS is proposing the SBMs align their open enrollment periods with that of HealthCare.gov, so that they would begin on November 1 and end no earlier than January 15. SBMs would have the option to extend the open enrollment period beyond January 15. Most SBMs already hold open enrollment periods that end on or after January 15, but HHS believes there is a risk of shorter open enrollment periods among some SBMs in the future. The agency further notes that a standard open enrollment period across states will help reduce consumer confusion.

Special Enrollment Periods (SEPs): Aligning Coverage Effective Dates

For the FFMs and SBM-FPs, consumers who qualify for a SEP generally can expect that their coverage will begin on the first day of the month after the consumer’s plan selection. For example, if a consumer selects a plan on May 31, their Marketplace coverage will start on June 1. However, in some SBMs, if a consumer selects a plan between the 16th day and the last day of a month, their coverage will not become effective until the first day of the second month after plan selection. In other words, if the consumer selects the plan on May 17, their coverage would not begin until July 1.

HHS notes that such a policy towards coverage effective dates can expose consumers to gaps in coverage of a month or more. Under this proposal, all SBMs, no later than January 1, 2025, will be required to align their coverage effective date policies with the FFM’s, so that consumers selecting plans in the latter half of a month can start their coverage on the first of the following month.

Minimum Standards For Network Adequacy

Beginning in plan year 2023, insurers in the FFMs have had to comply with federal standards for network adequacy that include a maximum time or distance an enrollee must travel to access provider services. Under this proposal, SBMs and the SBM-FPs would have to establish their own quantitative time and distance network adequacy standards for Marketplace plans that are “at least as stringent” as those in place in the FFMs.

In addition, SBMs and SBM-FPs would be required to review plan networks before they certify plans for Marketplace participation, consistent with the annual reviews conducted by the FFMs. SBMs and SBM-FPs would be prohibited from simply accepting an insurer’s attestation as the only mechanism to determine compliance with network adequacy standards. As HHS does, SBMs and SBM-FPs would be permitted to allow insurers that cannot meet their standards to submit justifications that account for deficiencies and potentially still be certified. SBMs and SBM-FPs would also be required to require insurers to submit information about whether their network providers offer telehealth services.

While the National Association of Insurance Commissioners (NAIC) has adopted a network adequacy model law, HHS notes that the model does not specify what constitutes network adequacy and further, that it has only been adopted by a few states. Roughly ¼ of SBMs and SBM-FPs do not have any quantitative standards for network adequacy of Marketplace plans.

The agency has also observed a “proliferation” in recent years of Marketplace plans with narrow provider networks, noting that these plans may lack access to certain provider specialties, resulting in significant costs for consumers who must obtain care out-of-network. As a result, the agency has received many public comments asking that they extend federal network adequacy standards to SBMs, arguing for a strong federal floor that should be met in all states.

HHS acknowledges that some SBMs have robust, quantitative network adequacy standards that differ from the FFM’s standards. They thus propose a process for granting exceptions to this policy, if HHS determines that the SBM’s standards ensure reasonable access for plan enrollees, and the SBM (or SBM-FP) conducts a network review before certifying the plans. The agency seeks comments on how to administer such an exceptions process.

If an SBM or SBM-FP fails to comply with the network adequacy standards, HHS notes that it could seek to take remedial action under its authorities related to Marketplace program integrity.

Selecting And Updating Essential Health Benefits

The ACA requires insurers in the individual and small group markets to offer plans with benefits that are equivalent to those offered in a typical employer plan, and cover, at a minimum, ten “essential” categories of benefits, specifically: hospitalization, emergency care, ambulatory services, prescription drugs, pediatric care, maternity and newborn care, behavioral and substance use disorder services, preventive care, laboratory services, and rehabilitative and habilitative services. States may adopt benefit mandates in addition to the essential health benefits (EHB), but if they do, the ACA requires them to defray the additional associated premium costs.

Rules implementing the ACA’s EHB standards delegated to states the task of identifying an EHB “benchmark” plan. Any state benefit mandates enacted prior to December 31, 2011 would be considered part of EHB and their costs would not have to be defrayed by the state. States would have to defray the cost of benefit mandates in addition to EHB enacted after that date.

Adjustments To The EHB “Defrayal” Policy

HHS notes that it has received feedback on the “defrayal” policy suggesting that states have struggled to understand and operationalize the requirements, and that some state efforts to mandate certain benefits could unintentionally be removing EHB protections from benefits already included in the state’s EHB-benchmark plan. The agency therefore proposes to amend its rules to clarify that a covered benefit in the state’s EHB-benchmark plan is considered an EHB. In other words, if a state mandates coverage of a benefit that is already in the EHB benchmark plan, the benefit would continue to be considered EHB, and there would be no defrayal requirement. HHS argues that this change will make the identification of benefits in addition to EHB “more intuitive.” The agency acknowledges that there are states that may have been defraying the costs of benefits under the current policy that would be able to stop if this proposal is finalized.

This proposal could impact health plans that are not directly subject to the EHB requirements, such as self-insured group health plans and fully insured large group health plans. Under the ACA, these plans must establish annual limits on cost-sharing and restrictions on annual or lifetime dollar limits in accordance with the applicable EHB benchmark. However, such plans would only be affected if the state changes benefits in its EHB-benchmark plan and the plan selects that State’s EHB-benchmark plan for purposes of complying with the ACA’s annual cost-sharing limits and restrictions on annual or lifetime dollar limits.

State Selection Of EHB-Benchmark Plans

HHS is proposing a set of changes to the standards and process for states to select new or revised EHB-benchmark plans, beginning on or after January 1, 2027. In its 2019 NBPP, HHS established new options for states to select an EHB-benchmark plan. Under that rule, states seeking to change their benchmark plans had to comply with two scope of benefit standards:

- The typicality standard: The state’s proposed EHB-benchmark plan must provide a scope of benefits equal to the scope of benefits provided under a typical employer plan. A “typical” employer plan could be either one of the state’s 10 base-benchmark plan options from the 2017 plan year or the largest health insurance plan by enrollment within one of the five largest large group health insurance products.

- The generosity standard: The state’s proposed EHB-benchmark plan must provide a scope of benefits that does not exceed the generosity of the most generous plan among a set of comparison plans used for the 2017 plan year.

HHS has received feedback from states that the typicality standard, as implemented, is a burdensome mechanism to ensure that a benchmark plan is equal in scope to a typical employer plan. The agency has also heard that the generosity standard impedes states’ ability to select an EHB-benchmark plan that is equal in scope to the benefits provided by a typical employer plan in the state, as states have found these plans to have become more generous over time. States have also commented that the current requirement to provide HHS with a formulary drug list as part of their EHB-benchmark updating process is an onerous one when the state is not seeking to change the prescription drug benefits.

HHS notes that since 2019, states have been required to perform detailed actuarial analyses to gain approval of new or updated EHB-benchmark plans. States must first assess the value of the current EHB-benchmark plan and then determine how that valuation increases or decreases depending on their proposed plan modifications. Next, the state must assess the value of each typical employer plan option to identify an exact match for the expected value offered by the proposed plan. To find such a match, the State may need to assess the value of many typical employer plan options, and determine whether supplementation is necessary, which requires both additional time and potentially additional costs for actuarial services. HHS has observed that the existing typicality standard inhibits the ability of states to innovate benefits because it generally requires an exact actuarial match.

Therefore, HHS is proposing to consolidate the options for states to change their EHB-benchmark plans. The agency would revise the typicality standard so that the scope of benefits of a typical employer plan in the state would be defined as any scope of benefits that is as or more generous than the scope of benefits in the state’s least generous typical employer plan, and as or less generous than the scope of benefits in the state’s most generous typical employer plan. Thus, under this proposal, states would need to assess only two typical employer plan options (the most and least generous available) to establish a range for the scope of benefits within which the state’s EHB-benchmark could then match. HHS is also proposing to remove the generosity standard.

If finalized, these proposals should reduce the time and cost to states seeking to update their EHB-benchmark plans and support a wider array of benefit changes to reflect changes in the employer coverage more broadly. HHS notes that employer plans are increasingly covering telehealth services, gender-affirming care, bariatric surgery, hearing aids, infertility treatment, routine dental care, and travel-related benefits.

Finally, HHS would revise current rules to require states to submit a formulary drug list as part of their documentation of EHB-benchmark changes only if they are proposing changes to the prescription drug benefit.

EHB Benefit Updates

Dental Benefits

Under current rules, insurers are barred from including routine adult dental benefits as part of EHB. However, HHS notes that oral health has a significant impact on overall health and quality of life. Inadequate access to oral health care is particularly prevalent among communities of color and people with low incomes. The agency is thus proposing to remove this regulatory prohibition, and to allow insurers to include routine non-pediatric dental services as an EHB. The agency seeks comment on whether it should apply similar changes with regard to routine non-pediatric eye exam services and long-term/custodial nursing home care benefits.

Prescription Drug Benefits

To meet EHB standards, insurers must cover at least the same number of drugs in every category and class as defined under the United States Pharmacopeia (USP) Medicare Model Guidelines (MMG), or one drug in every category and class, whichever is greater. HHS is seeking comment on whether to replace the USP MMG with the USP Drug Classification system (DC) to classify the prescription drugs required to be covered as EHB. In response to HHS’ recent Request for Information (RFI) on EHB, many commenters advocated transitioning to the USP DC because it is more inclusive of drug classes relevant to the population covered in private health insurance. It is also updated annually, while the USP MMG is updated only once every three years. HHS also notes that the USP MMG includes gaps in coverage related to treating chronic conditions such as obesity, infertility, and sexual disorders.

HHS is requesting comments on the potential financial effects of shifting to the USP DC, with a particular interest in the effects of covering anti-obesity medications.

The 2013 federal rules implementing the ACA’s EHB standards stated that while plans must offer at least the greater of one drug for each USP category and class or the number of drugs in the EHB-benchmark plan, plans are permitted to go beyond the number of drugs offered by the benchmark plan without exceeding EHB. This means that if a plan is covering prescription drugs beyond those covered by the benchmark plan, they are considered EHB and must count towards the annual limit on cost-sharing. However, in response to the recent RFI, a “significant number” of commenters reported that some plans are asserting that they are covering drugs in excess of the EHB rule’s drug count standards, and consider those drugs as “non-EHB.” In response, HHS is proposing in this rule to explicitly state that drugs in excess of the benchmark are to be considered EHB, and thus required to count towards the annual limitation on cost-sharing.

Lastly, HHS is proposing to require, beginning in plan year 2026, that insurers’ Pharmacy & Therapeutics (P&T) Committees include at least one consumer representative. The agency notes that P&T committees are usually composed of actively practicing physicians, pharmacists, and other health care professionals, and rarely include a patient representative. If finalized, insurers would be required to select a consumer representative with experience in the analysis and interpretation of complex data and able to understand its public health significance. Such representatives could not have a fiduciary obligation to a health facility or other health agency and must have no material financial interest in the rendering of health services.

Improving Consumers’ Enrollment Experience

The proposed rule includes several provisions designed to expand consumers’ enrollment opportunities, reduce paperwork burdens, and simplify the process of applying for and enrolling in Marketplace coverage.

Special enrollment periods for low-income individuals

The 2022 Payment Notice created a monthly special enrollment opportunity for individuals at or below 150 percent of the federal poverty level (or $21,870 in annual income for a single individual in 2023), but only for so long as premium tax credits are available such that the enrollee’s premium contribution percentage is set at 0 percent. Under current law, the subsidy enhancements under the American Rescue Plan Act and Inflation Reduction Act are available through plan year 2025. Once they expire, so too would this special enrollment opportunity.

HHS has found that this special enrollment opportunity has significantly expanded opportunities for people at or under 150 percent FPL to enroll in free or extremely low-cost Marketplace coverage. The agency notes that between October 2022 and August 2023, about 1.3 million people in FFM and SBM-FP states enrolled through this special enrollment opportunity. The 150 percent FPL special enrollment opportunity has helped increase the proportion of enrollees on the FFMs with incomes under 150 percent FPL from 41.8 percent in 2022 to 46.9 percent in 2023. HHS also highlights the importance of maintaining this special enrollment right as an additional safety net for individuals transitioning from Medicaid or CHIP coverage to a Marketplace plan.

Therefore, HHS is proposing to remove the limitation that this special enrollment opportunity be available only while the IRA’s subsidy enhancements are in place. HHS acknowledges that once the IRA’s subsidies expire, it is possible that there could be an increase in adverse selection, as these individuals are required to pay premiums for their Marketplace coverage. However, the agency believes the risk of adverse selection is relatively low, and that many individuals below 150 percent FPL will continue to be eligible for zero-premium Marketplace plans.

Advance Notice Of APTC Risk Due To Failure To Reconcile

HHS proposes to require Marketplaces to give enrollees advance notice that they are at risk of losing eligibility for APTC due to failing to file and reconcile APTC on their income tax return (a rule referred to as “FTR”).

Under the ACA, consumers receiving APTC must file a tax return to reconcile the APTC against the PTC they are due based on their actual circumstances for the year. An individual who fails to reconcile is subject to the IRS’s normal enforcement tools for failing to properly file a return. In 2012 regulations, HHS created an additional penalty for individuals who fail to reconcile: the denial of APTC for future years. This rule raised concerns about administrative burden, given complex tax filing rules, restrictions on Marketplaces communicating with consumers about FTR status, and delays in IRS return processing. In the 2024 Payment Notice, HHS modified FTR rules to deny APTC only after two consecutive years of failing to reconcile APTC. This approach gives consumers more time to understand and address FTR issues and the IRS more time to ensure returns are processed, while also limiting the risk of APTC loss to the most concerning cases.

The 2024 Payment Notice did not address how the Marketplace should notify consumers of their risk of losing APTC due to FTR status. The proposed 2025 NBPP would require that Marketplaces notify consumers of this risk after one year of failing to reconcile APTC—a year in advance of APTC loss. Because of tax data privacy rules, these notices may not be clear about the problem. For example, if the primary applicant for the coverage unit does not file a tax return for all members of the coverage unit, the notice may need to note multiple possible reasons for APTC loss. Nonetheless, the notices will give consumers a year to figure out the issue and address it before losing APTC.

Standardized Plan Options

HHS is proposing only minor updates to the standardized plan designs it introduced for the 2023 plan year. For plan year 2024 and beyond, the agency finalized standardized plans as follows:

- One bronze plan that meets the requirement to have an actuarial value up to five points above 60 percent (known as an expanded bronze plan);

- One standard silver plan;

- One version of each of the three income-based silver cost-sharing reduction (CSR) plan variations; and

- One platinum plan.

HHS is making modifications to these plan designs solely to ensure that they remain within the permissible de minimis range for each metal level. The agency is also seeking comment on whether to require insurers in SBMs to offer some version of standardized plan options.

Limits On Non-Standardized Plans

In its 2024 NBPP, HHS limited the number of non-standardized plan options that insurers can offer through the FFMs and SBM-FPs to four plans per service area in each combination of the following categories:

- Product network type;

- Metal level (excluding catastrophic plans);

- Inclusion of dental and/or vision coverage;

This four-plan limit will drop to two for each combination of the above categories for plan year 2025 and beyond. This policy is expected to reduce the weighted average number of plans available to consumers from 91.8 in plan year 2024 to approximately 66.2 in plan year 2025.

For 2025, HHS is proposing to offer insurers an exceptions process that would allow them to offer additional non-standardized plan options per product network type, metal level, inclusion of dental and/or vision benefit coverage, and service area. Insurers would need to demonstrate that these additional plan designs would “substantially benefit” consumers with chronic and high-cost conditions. To do so, they would need to show that the cost-sharing in these plans for services to treat chronic and high-cost conditions is at least 25 percent lower than the cost-sharing for the same corresponding benefits in the insurer’s other non-standardized plan options in the same product network type, metal level, and service area. Insurers would be required to apply the reduced cost sharing for these benefits any time the covered item or service is furnished.

HHS argues that creating this exceptions process will allow them to balance the “dual aims” of reducing the risk of plan choice overload with the opportunity to offer innovative plan designs that might benefit consumers with chronic and high-cost conditions. HHS seeks comment on this proposal, particularly whether exceptions should be permitted for only certain chronic or high-cost conditions, whether there are other plan attributes that should be considered in addition to cost-sharing, as well as the choice of a 25 percent threshold difference in cost-sharing.

Additional Flexibility For Basic Health Program (BHP) Effectuation Dates

HHS proposes to modify the rules around effective dates for BHP coverage to give states an additional option that could speed up some enrollments. Currently only Minnesota and New York operate BHPs, and Oregon appears on track implement one in July of 2024.

Under current rules, states must choose a uniform set of rules for determining the effective date of all BHP coverage—either the Medicaid rules or the Marketplace rules. The Medicaid rules generally allow for the earliest possible effective date for enrollees, including retroactive coverage in some cases. But HHS reports that some states find it infeasible to adopt the Medicaid rules. The Marketplace rules, on the other hand, may substantially delay enrollment for some consumers. For example, applying in the second half of a month may mean coverage is delayed until the beginning of the second succeeding month.

HHS proposes to permit states to choose a middle ground, where all coverage is effective on the first day of the month after the eligibility determination is made. This will permit states that are unable to adopt the Medicaid rule to effectuate enrollment more quickly.

Website Display Requirements For DE Entities

HHS is proposing to require that DE entities adopt and prominently display changes on HealthCare.gov within a specified notice period set by HHS. The agency regularly monitors DE entities through website reviews, and has identified numerous areas where DE entities can improve their user experience and more closely align with HealthCare.gov. Currently, when HHS makes important changes to HealthCare.gov, it communicates those to DE entities and requires them to make their own changes to conform to HealthCare.gov.

This proposal is intended to improve the consumer experience, simplify plan selection, and increase consumer understanding of benefits and their eligibility for financial help. With the steady increase in the number of consumers enrolling in Marketplace coverage through DE entities, the agency believes that it is especially important that DE entities’ websites quickly and accurately reflect changes in Marketplace websites.

Generally, HHS would provide DE entities with approximately 30 days of advance notice of a simple display change and 90 or more days for more complex changes. However, the agency notes that there could be emergent situations where it would provide less than 30 days advance notice, but never less than 5 days advance notice. The agency is also cognizant that some DE entities have system constraints that prevent a perfect mirroring of the HealthCare.gov website approach, and thus may permit deviations. DE entities seeking a deviation must submit a proposed alternative display and accompanying rationale.

SBMs would also be required to establish and communicate standards for required display changes to DE entities, and set time period by which those changes must be implemented.

Increase State Flexibility To Use Income And Resource Disregards For Non-MAGI Medicaid Eligibility

HHS proposes to permit state Medicaid programs to tailor their use of income and resource disregards to ease eligibility rules for specific populations.

The ACA simplified Medicaid eligibility for many populations, generally tying income eligibility to modified adjusted gross income (MAGI)—the same measure used for APTC eligibility—and prohibiting resource tests that look at an individual’s financial assets. However, the pre-existing, non-MAGI rules continue to apply for specific populations, including individuals who are aged 65 years or older, are blind or disabled, or are being evaluated for coverage as medically needy. Under these non-MAGI rules, states may still impose resource tests, and states may ease eligibility by “disregarding” specified amounts of income and resources. Long-standing regulations limit states’ ability to target these disregards to specific populations. If a state provides a certain disregard for a certain eligibility group, it must generally do so for all individuals in that group, rather than, for example, limiting the disregard to individuals with a cognitive impairment. These restrictions have limited states’ ability to target assistance to those most in need.

HHS proposes to expand flexibility to tailor disregards by eliminating this “all or nothing” rule. This would allow states to target disregards “at discrete subpopulations in the same eligibility group, provided the subpopulation is reasonable and does not violate other Federal statutes (for example, it does not discriminate based on race, gender, sexual orientation or disability).” HHS recognizes that a state could potentially use the new flexibility to scale back an existing disregard, but they believe it is more likely that it will be used to expand eligibility.

Flexibility To Accept Attestation As To Incarceration Status

HHS proposes to permit Marketplaces to accept applicants’ attestation that they are not incarcerated to establish eligibility, rather than requiring a search of third-party data, which has proven inaccurate, resulting in administrative burdens for applicants.

The ACA prohibits Marketplace enrollment of incarcerated individuals, unless they are incarcerated pending the disposition of charges. Marketplaces are currently required to check a third-party database for indications of current incarceration. If an applicant attests to not being incarcerated but the database suggests they may be, the Marketplace must generate a “data matching issue” (DMI). The applicant must then resolve the DMI by submitting additional documentation to substantiate that they are not incarcerated.

HHS has found that this requirement leads to many unnecessary DMIs, while providing little benefit. A study of 110,802 incarceration DMIs found that 96.5 percent of them were resolved in favor of the applicant. This makes sense, as an individual who is truly incarcerated would have little reason to apply for Marketplace coverage, especially since APTC are unavailable at incomes below 100 percent of FPL. The current system also aggravates racial inequities, given disparities in rates of interactions with the criminal justice system.

HHS proposes to permit Marketplaces to accept applicant attestation that they are not incarcerated. A Marketplace would be still be permitted to propose using an electronic data source for verifying incarceration status, subject to HHS approval that the alternative data source would maintain accuracy and minimize administrative costs, delays, and burdens on individuals. In that case, if the individual’s attestation was inconsistent with information from the data source, a DMI would be generated, as under current rules.

HHS estimates that this proposal would result in only a small number of erroneous enrollments, while eliminating unnecessary administrative burdens for many applicants.

Periodic Data Matching During A Benefit Year

HHS proposes to require Marketplaces to conduct periodic data matching (PDM) for evidence of enrollee death twice per year.

Long-standing regulations require Marketplaces to conduct PDM to identify individuals enrolled in Medicare, Medicaid, CHIP, or BHP coverage (where applicable), and for evidence of enrollee death. Marketplace must check for other coverage no less than twice per year, but the frequency of PDM for death is not specified. The FFMs and SBM-FPs currently conduct PDM for death twice per year, but many SBMs do so less often.

HHS proposes to require PDM for death to follow the same twice-a-year cadence as other PDM. This would help standardize Marketplace policy and minimize the risk of erroneous APTC payment. HHS notes that 11 SBMs are not currently meeting this standard. However, since all of them have PDM systems in place, complying with the twice-a-year requirement would have minimal cost—a few thousand dollars per year.

HHS also proposes to revise PDM rules to grant the Secretary authority to temporarily suspend PDM requirements in situations that may cause PDM data to be less available, such as a declared national public health emergency.

Auto Re-Enrollment For People With Catastrophic Coverage

Each year, approximately one-third of Marketplace enrollees who do not proactively select a new plan during open enrollment are automatically re-enrolled into a Marketplace plan for the next plan year. In general, Marketplace rules state that if an enrollee’s plan has been discontinued, and they do not actively select a new plan, the Marketplace will auto re-enroll them into a new plan based on their current product, metal level, and plan network type. However, current regulations do not require automatic re-enrollment of people enrolled in catastrophic coverage.

HHS is proposing to update its automatic re-enrollment policies to require Marketplaces to re-enroll people enrolled in catastrophic plans for the next plan year. The agency notes that some SBMs already do this, but argues that making it a national requirement will help ensure continuity of coverage when an insurer discontinues a catastrophic plan and people enrolled in that plan do not actively select a new Marketplace plan. At the same time, HHS also proposes prohibiting a Marketplace from auto re-enrolling someone who is enrolled in a metal level plan (bronze, silver, gold, or platinum) into a catastrophic level plan.

Under the ACA, only individuals who are younger than 30, those for whom metal level coverage is deemed unaffordable, or who qualify for a hardship exemption are eligible to enroll in a catastrophic plan. Individuals enrolled in catastrophic plans are not eligible for premium tax credits. Under this proposal, if an individual enrolled in a catastrophic plan no longer qualifies for that plan in the next plan year, the Marketplace would auto re-enroll that person into a bronze plan in the same product, and with a network similar to the individual’s current plan. If no bronze plan is available through the same product, the Marketplace would re-enroll the individual into a plan with the lowest coverage level offered under the same product, and with the most similar network as the individual’s current plan.

HHS asks for comments on these proposals, particularly from SBMs regarding whether these policies reflect their current auto re-enrollment practices.

Premium Payment Deadline Extensions

HHS proposes to clarify that Marketplaces may, and that Marketplaces using the federal platform will, permit Marketplace insurers to provide reasonable extensions to deadlines for making premium payments in certain circumstances.

Effectuating Marketplace enrollment generally requires the applicant to make the first monthly premium payment, referred to as a “binder payment.” The 2018 Payment Notice provided that Marketplaces may—and Marketplaces using the federal platform will—permit insurers to extend deadlines for binder payments when they are “experiencing billing or enrollment problems due to high volume or technical errors.” However, HHS has also interpreted this flexibility to apply to additional payments and circumstances. For example, in response to the COVID-19 pandemic, HHS released guidance in March of 2020 permitting insurers to extend premium deadlines generally.

HHS now proposes to modify the regulations to reflect the scope of available flexibility. It would clarify that insurers may permit deadline extensions for all premium payments and in additional circumstances—namely, where insurers are directed to provide extensions by federal or state authorities.

Permitting Retroactive Termination In Additional Circumstances

HHS proposes to permit Marketplaces to allow retroactive termination of coverage to avoid duplicate coverage in situations where Medicare Part A or Part B coverage takes effect retroactively. The FFMs would permit this retroactive termination, and SBMs could decide whether to do so as well.

HHS currently permits retroactive termination of Marketplace coverage only in very limited circumstances. In the FFMs, it is permitted only where coverage was extended due to a mistake or malfeasance outside the enrollee’s control: where a technical error prevented an enrollee from terminating coverage or cancelling enrollment; where enrollment was unintentional and due to an error or misconduct by the Marketplace, HHS, or an enrollment assistance entity; or where enrollment occurred without the enrollee’s knowledge or consent. In addition, SBMs and SBM-FP have the option to permit retroactive termination of Marketplace coverage in cases of retroactive Medicaid enrollment; the FFMs do not permit this.

HHS cites several reasons for tightly limiting retroactive termination. Individuals with little utilization might seek to game the system by terminating to recover premiums paid, creating adverse selection and program integrity concerns. Marketplace plan network providers could be left with no one to bill for services they provided, especially given the relatively limited provider networks of many Medicaid programs.

Notwithstanding these concerns, HHS now proposes to permit retroactive Marketplace termination where the consumer has been retroactively enrolled in Medicare Part A or B. Retroactive Medicare enrollment may occur where an individual turning 65 is not automatically enrolled and does not immediately enroll themselves. It may also happen where an individual is retroactively approved for SSDI benefits extending back more than 25 months. HHS notes that, in such cases, the consumer may have had no way to know at the time that they would be Medicare eligible. HHS also notes that Medicare provider participation is generally broader than for Medicaid.

Other Proposals

The proposed 2025 NBPP includes additional provisions establishing user fee rates, updating public notice requirements for Section 1332 waivers, requiring states to start paying for a federal data service, updating loan requirements for CO-OP plans, clarifying the entity responsible for handling brokers’ requests for reconsideration, updating payment parameters, and aligning payment and collections processes with federal independent dispute resolution rules under the No Surprises Act.

User Fees

HHS proposes to hold the 2025 Exchange user fees rates steady at 2024 levels: 2.2 percent for FFMs and 1.8 percent for SBM-FPs.

User fees are paid by Exchange issuers to support the operations of the FFM and federal platform. The fee is calculated as a percentage of Exchange premiums collected. The preamble indicates that these levels would provide funding sufficient to “fully fund user-fee eligible Exchange activities,” which include eligibility and enrollment processes; outreach and education; managing navigators, agents, and brokers; consumer assistance tools; and certification and oversight of Marketplace plans.

The fee rates have fallen in recent years. The preamble notes that the proposed rates are sufficient in part due to increased enrollment resulting from the recent extension of PTC enhancements.

1332 Waivers

The NBPP includes a proposal from HHS and the Treasury Department (the Departments) to modify the section 1332 public meeting requirements to permit states to hold meetings virtually or hybrid (in-person and virtual) without any special permission.

Section 1332 permits states to apply to the Departments for a waiver of the ACA’s central coverage provisions. The waiver mustn’t adversely affect coverage, affordability, comprehensiveness, or federal deficits. Before an application is submitted, the state must collect public comment, including through public hearings. Regulations finalized in 2012 require both these hearings and post-approval annual forums to be conducted in-person. In response to the COVID-19 pandemic, the Departments issued emergency regulations, since made permanent, allowing states to ask permission to make these meetings virtual.

The Departments now propose to permit these public meetings to be virtual or hybrid at state option. The Departments note that states report that virtual hearings have worked well, do not seem to have adversely affected attendance, and address some concerns about accessibility. Other federal programs have also moved towards virtual or hybrid public meetings in recent years. The proposal would not change requirements for public notice, comment periods, or consultation with Indian tribes.

Verification Process For Eligibility For Insurance Affordability Programs

HHS proposes to require state Marketplaces and Medicaid agencies that use an optional income data service through the federal Data Services Hub to start paying to do so, consistent with a revised legal interpretation.

As part of implementing the ACA, HHS created the federal Data Services Hub (the Hub) to securely share information between federal agencies and state Marketplaces and Medicaid agencies. Through the Hub, states can access federal data to assist with eligibility determinations, including data from the Internal Revenue Service (IRS), the Social Security Administration, and the Department of Homeland Security. The Hub can also be used to access a private service providing recent income information, referred to as “Verify Current Income” (VCI). States agencies can use VCI to supplement tax data from the IRS. HHS notes that, as of June 2023, 32 states plus the District of Columbia and Puerto Rico use the VCI Hub service for their Medicaid and CHIP programs, and 10 of those States also use the service for their SBMs.

Under rules governing the Hub, if accessing a data source through the Hub is deemed to be a state “agency function,” the state must pay to use that service. Until now, the use of VCI has not been considered an agency function, so it has been free to states. HHS has now determined that the use of VCI is properly considered an agency function, so states must pay for it. HHS proposes to change regulations on Marketplace use of data sources to clarify that states must pay to use VCI. Medicaid agencies can be required to pay without regulatory changes. Medicaid agencies could receive federal matching funds for this expense, and Marketplaces could fund them through their user fees. HHS also proposes procedures by which states would pay for the service.

These changes would be effective July 1, 2024, though HHS specifically requests comment on this effective date.

CO-OP Loan Terms

HHS is proposing to permit CO-OP plans to voluntarily terminate their loan agreements with CMS so that they can pursue new business plans that do not meet the ACA’s governance and business standards for CO-OPs. The ACA and its implementing regulations for the CO-OP program mandate that at least two-thirds of the policies issued by a CO-OP be offered in the individual and small-group markets. Additionally, CO-OPs are subject to governance by a majority vote of its members. As a result, CO-OPs cannot pursue new business arrangements that would result in a majority of directors who are not covered by health plans issued by the CO-OP. Nor can they enter into an arrangement in which less than two-thirds of their business consists of issuing individual or small-group market ACA plans.

HHS argues that allowing CO-OPs to terminate their loan agreements would enable them to expand their operations and offer additional health insurance products, while maintaining their non-profit status.

Reconsideration Entity For Agents, Brokers, And Web-Brokers

Agents, brokers, and web-brokers whose agreements with the Marketplace have been terminated for cause can request a reconsideration of that decision from HHS. In this draft rule, HHS would delete current references to “the HHS reconsideration entity” and replace them with “the CMS Administrator. This would clarify that the CMS Administrator, as a principal officer, would be the entity responsible for handling these reconsideration decisions.

Updated Numerical Parameters

Along with the proposed regulations discussed above, HHS released its annual subregulatory guidance providing updated values for certain numerical policy parameters established by the ACA. The included parameters are indexed using a factor called the “premium adjustment percentage” (PAP), which is based on premium growth in the group market. The PAP is calculated as estimated premium growth between 2013 and the preceding year—in this case, 2024. For 2025, the PAP is 1.4519093322, meaning that premiums are estimated to grow about 45.2 percent between 2013 and 2024. (For reference, this comes out to an average annual growth rate of about 3.45 percent.) This is lower than the 2024 PAP of about 1.49. The decline reflects the net effect of including an additional year of premium growth (which increases the PAP) and the incorporation of additional data for recent years (which substantially reduced the PAP).

Using the updated PAP, the guidance provides the following parameters for 2025:

Caps On Maximum Out-Of-Pocket Spending (MOOPs)

The ACA requires most health coverage, including insurance in the individual and group markets and self-insured group health plans, to limit enrollees’ out-of-pocket spending by covering the full cost of covered services once the enrollee has spent a certain amount. This maximum out-of-pocket amount (MOOP) cannot exceed certain caps, which differ for self-only vs. other coverage and for the various CSR silver variants in the Marketplace. The MOOP caps are updated each year using the PAP, and then in some cases adjusted to ensure consistency with required actuarial values. For 2025, the MOOP caps are as follows:

- CSR plans for consumers with household incomes between 100 percent and 150 percent of the federal poverty level (FPL): $3,050 for self-only coverage, $6,100 for other coverage

- CSR plans for consumers with household incomes between 150 percent and 200 percent of FPL: $3,050 for self-only coverage, $6,100 for other coverage

- CSR plans for consumers with household incomes between 200 percent and 250 percent of FPL: $7,350 for self-only coverage, $14,700 for other coverage

- All other plans: $9,200 for self-only coverage, $18,400 for other coverage

Required Contribution Percentage for Catastrophic Plan Eligibility

Under the ACA, an individual aged 30 or over may enroll in a catastrophic health plan only if other coverage options are deemed “unaffordable,” meaning that the premium exceeds the individual’s income times a “required contribution percentage.” The required contribution percentage was set at 8 percent for 2014 and is updated annually based on the ratio between premium growth since 2013 (i.e., the PAP) and total personal income growth over the same period. The guidance reports that personal income grew about 59.5 percent between 2013 and 2024—substantially more than the 45.2 percent premiums grew over the same period, as reflected in the PAP. As a result, the required contribution for 2025 falls to 7.28 percent—its lowest value ever.

Independent Dispute Resolution (IDR) Administrative Fees

The draft rule includes a provision to ensure that the administrative fees for using the No Surprises Act IDR process are subject to netting as part of HHS’ integrated monthly payment and collections cycle.

Author’s Note

The Robert Wood Johnson Foundation provided grant support for the author’s time researching and writing this post.

Sabrina Corlette and Jason Levitis, “Proposed 2025 Payment Rule: Marketplace Standards And Insurance Reforms,” Health Affairs Forefront, November 20, 2023, https://www.healthaffairs.org/content/forefront/proposed-2025-payment-rule-marketplace-standards-and-insurance-reforms. Copyright © 2023 Health Affairs by Project HOPE – The People-to-People Health Foundation, Inc.